Union vs. Non-Union Construction Payroll: Key Differences Explained

Understanding the differences between union and non-union payrolls remains crucial for employers and workers in the construction industry. These distinctions directly impact wages, benefits, and job security. Union payrolls operate under collective bargaining agreements that establish predetermined wages and benefits, while non-union payrolls give employers more latitude in setting individual compensation packages. With the construction industry projected to need 499,000 new workers in 2026, understanding these payroll systems matters more than ever for both workers making career decisions and contractors managing their workforces.

Introduction: Understanding Union vs Non-Union Construction Payroll

Construction payroll operates differently depending on whether workers belong to a labor union. Both systems follow distinct rules for compensation, benefits, and working conditions. With the construction labor shortage intensifying and average hourly construction wages reaching $39.33 in 2025, these differences carry significant financial implications for workers choosing between union and non-union employment.

Union vs. Non-Union Construction Workers

In construction, “union” refers to workers represented by legally recognized labor organizations that negotiate collectively for better conditions, wages, and benefits. Non-union workers operate independently without union representation. These differences manifest clearly in employment terms and compensation.

Differences in Employment Conditions and Pay Rates

Union Construction Workers:

Collective Bargaining Agreements: Union workers benefit from contracts negotiated between their union and employers. These agreements specify wage rates, overtime rules, and benefits. Recent data from March 2024 to March 2025 shows union construction workers received an average 4.5% pay increase, compared to 3.2% for non-union workers.

Job Security and Legal Protection: Unions provide protection against arbitrary dismissal and offer legal support in workplace disputes. This backing reduces uncertainty about job stability and provides resources that workers couldn’t access on their own.

Standardized Benefits: Union members typically receive health insurance, retirement plans, and paid leave as standard benefits. The hourly value of benefits for union workers averages $22.26, significantly higher than the $11.32 received by non-union workers.

Non-Union Construction Workers:

Individual Negotiations: Non-union workers negotiate their own terms directly with employers. While this allows for flexibility, it also means workers must advocate for themselves without organizational backing. Success depends heavily on individual negotiating skills and market conditions.

Variable Compensation: Pay rates for non-union workers vary considerably based on location, employer, and individual negotiations. This variability can create significant wage disparities between workers performing similar tasks.

Inconsistent Benefits: Benefits for non-union workers differ widely between employers. While some contractors offer competitive packages, benefits are neither guaranteed nor standardized. Only 69% of non-union construction workers have health insurance, compared to 96% of union members.

What’s the Difference Between Union and Non-Union Construction Payroll?

The primary distinctions between these payroll systems center on compensation structure, benefits administration, compliance requirements, and union dues.

Key Differences Between Union and Non-Union Construction Payroll

These payroll systems operate under fundamentally different frameworks. Union payroll follows collective bargaining agreements, while non-union payroll depends on individual employer policies and market conditions.

Wages, Benefits, Compliance, and Union Dues

Wages

Union Construction Payroll: As of late 2025, union construction workers earn approximately $33.86 per hour on average, with total compensation (including benefits) reaching $56.12 per hour or $116,730 annually. Wages are established through collective bargaining and remain consistent across members performing similar work.

Non-Union Construction Payroll: Non-union workers average $25.16 per hour, with total compensation around $40.27 per hour or $83,760 annually. This represents a wage gap of approximately $8.70 per hour or 26% compared to union workers. Individual employers determine these rates based on market conditions, budget constraints, and negotiations.

Benefits

Union Construction Payroll: Union workers receive comprehensive benefits worth an average of $22.26 per hour. Health insurance alone accounts for $7.10 per hour, while retirement contributions add $4.85 per hour. These benefits are negotiated as part of collective agreements and apply uniformly to all members.

Non-Union Construction Payroll: Non-union workers receive an average of $11.32 per hour in benefits—roughly half the union rate. Benefit offerings vary significantly between employers, with some providing minimal or no benefits. This inconsistency means workers must carefully evaluate total compensation when comparing job offers.

Compliance

Union Construction Payroll: Employers must comply with collective bargaining agreements containing detailed provisions about overtime, pay scales, classifications, and worker protections. These agreements add complexity beyond standard labor law compliance and require careful payroll administration to avoid violations that could trigger disputes or penalties.

Non-Union Construction Payroll: Compliance focuses on federal and state labor laws without the additional layer of union-specific requirements. While this simplifies payroll processing, employers must still follow prevailing wage laws on public projects and standard employment regulations.

Union Dues

Union Construction Payroll: Workers pay dues to fund union operations, including contract negotiations, legal support, and training programs. These dues are typically deducted directly from paychecks. While this reduces take-home pay, members receive substantial benefits and wage premiums that typically exceed the cost of dues.

Non-Union Construction Payroll: No union dues apply, meaning workers keep their full earnings. However, they also forgo the collective bargaining power, legal resources, and standardized benefits that unions provide.

How Union Payroll Processing Differs from Non-Union Payroll

Processing union payroll involves unique challenges not present in non-union systems. These differences require specialized knowledge and careful administration.

Key Differences in the Payroll Processing Systems

.jpg)

Union payroll processing must accommodate collective bargaining agreement requirements, which can include multiple pay classifications, seniority-based adjustments, mandatory overtime rules, and complex benefit calculations.

Union-specific Requirements:

Multiple Deductions: Beyond standard tax withholdings, union payroll must calculate and process union dues, which vary by union and sometimes by worker classification or earnings level.

Benefits Administration: Union benefits require precise management according to collective agreements. This includes health and welfare fund contributions, pension plan payments, and sometimes apprenticeship or training fund contributions.

Classification and Pay Scales: Union contracts often specify different pay rates for various job classifications and experience levels. Payroll systems must track worker classifications accurately and apply the correct rates.

Overtime and Premium Pay: Union agreements typically contain specific overtime provisions, which may differ from standard labor law requirements. Some agreements mandate double-time pay in certain situations or require premium pay for weekend or night work.

Non-union payroll processing is more straightforward, focusing primarily on compliance with federal and state regulations rather than additional contractual obligations. The main requirements involve accurate time tracking, proper tax withholding, and standard benefit deductions where applicable.

Average Wages of Union and Non-Union Construction Workers in 2026

Current Wage Landscape

Recent 2025 data reveal significant wage differences between unionized and non-unionized construction workers. The gap extends beyond hourly rates to total compensation when benefits are included.

Union construction workers earn an average of $33.86 per hour in base wages, while non-union workers average $25.16 per hour. When benefits are factored in, union workers’ total compensation reaches $56.12 per hour compared to $40.27 per hour for non-union workers. This $15.85 per hour difference in total compensation equals approximately $32,970 annually for full-time work—a 39% premium for union membership.

Wage Differences Across Regions and Trades

Geographic location and specific trade classifications create substantial wage variations within both union and non-union categories.

Regional Variations:

High-cost metropolitan areas like New York, San Francisco, and Boston typically pay the highest construction wages. Union workers in these markets can earn $40-50 per hour or more, while non-union workers in the same cities typically earn $30-40 per hour. States with strong union presence, such as California, New York, Illinois, and Washington, show larger union wage premiums.

Conversely, southern and rural states with lower union density often show smaller wage gaps between union and non-union workers. In some cases, non-union workers in low-cost areas may have better purchasing power despite lower nominal wages, though they typically still lack the comprehensive benefits union workers receive.

The construction labor shortage affects wages regionally. Markets experiencing rapid growth—such as Phoenix, Nashville, and Austin—face severe skilled worker shortages, driving up wages for both union and non-union workers as contractors compete for talent.

Trade-Specific Differences:

Specialized trades command higher wages regardless of union status. Electricians working on data centers, renewable energy projects, or EV charging infrastructure earn premium rates, with union electricians in these sectors earning $45-85 per hour depending on experience and location.

Carpenters, plumbers, and HVAC technicians also see significant trade-based variations. Union journeymen in these trades typically earn 15-25% more than non-union counterparts with similar experience. The premium reflects both collective bargaining power and the comprehensive training programs unions provide.

Heavy equipment operators and crane operators represent the highest-earning tier, with experienced union operators commanding $75,000-90,000 annually, while non-union operators with similar skills typically earn $54,000-65,000.

Challenges in Union vs Non-Union Payroll Management

Managing Union vs Non-Union Payroll

Both payroll systems present distinct challenges for contractors and HR departments.

Complex Pay Structures: Union payroll involves managing multiple pay classifications, shift differentials, and contract-specific wage scales that change based on job type and experience level. Each classification may have different base rates, overtime multipliers, and benefit contribution requirements. Tracking these variables requires robust payroll systems and attention to detail.

Benefit Administration: Union workers receive standardized benefits requiring precise calculation and timely fund contributions. Missing contribution deadlines or miscalculating amounts can result in penalties and worker grievances. Non-union benefit administration varies by employer policy, which can simplify or complicate management depending on what’s offered.

Compliance Requirements: Union payroll demands adherence to collective bargaining agreements on top of federal and state labor laws. Violations can trigger union grievances, work stoppages, or legal action. Non-union payroll focuses on standard labor law compliance but must still meet prevailing wage requirements on public projects.

Administrative Workload: Union payroll typically generates more paperwork and reporting requirements. HR must stay current with union agreement updates, track multiple benefit fund contributions, and maintain detailed records for potential audits. This administrative burden requires dedicated resources and expertise.

Labor Shortage Impact: With the industry needing 499,000 new workers in 2026, both union and non-union contractors face recruitment and retention challenges. Labor costs are rising across both sectors, with construction wages outpacing wage growth in other industries. This puts pressure on payroll budgets and requires strategic workforce planning.

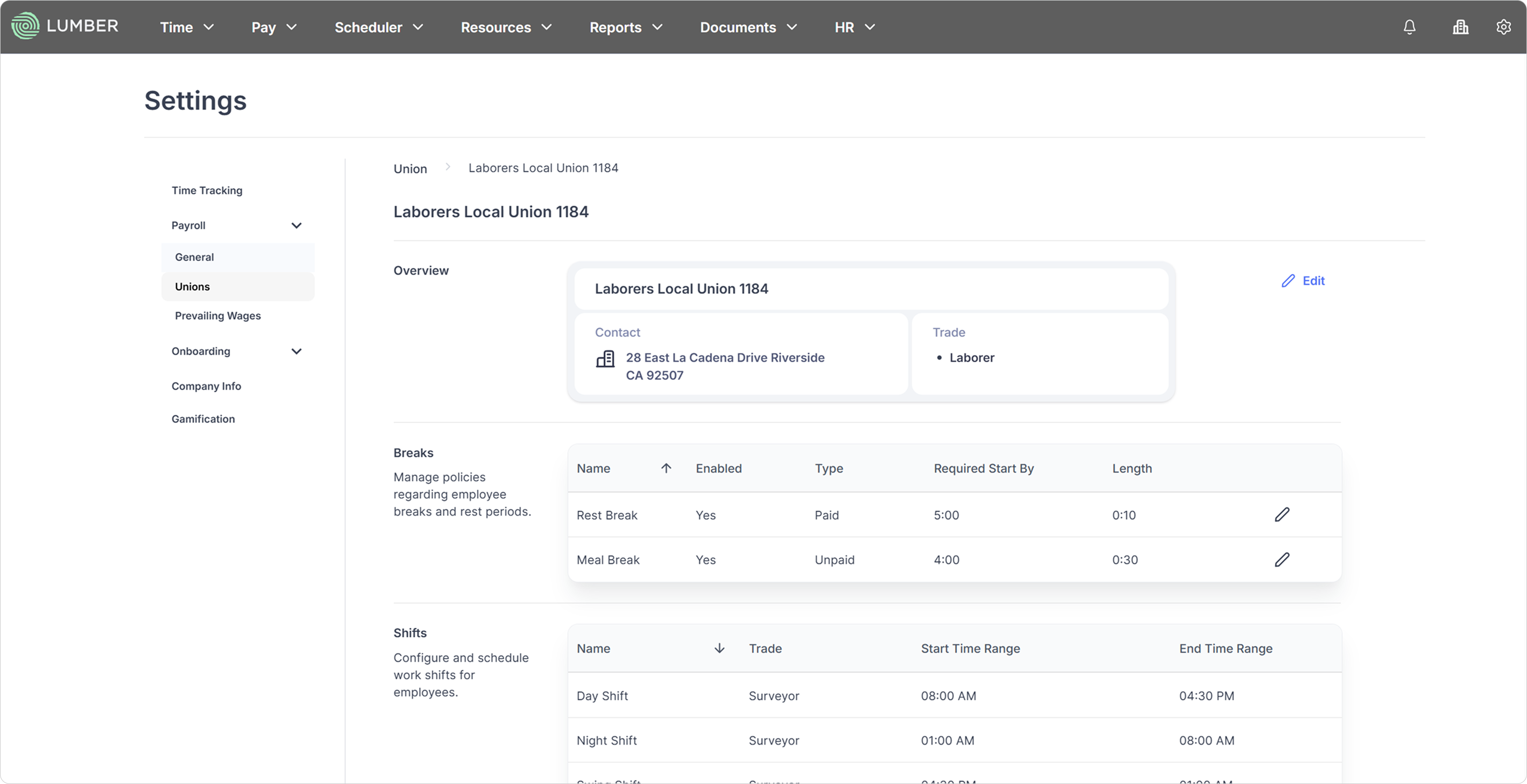

Streamline Union Payroll Processing with Modern Software

Managing union payroll complexity requires specialized software tailored to the construction industry.

How Modern Payroll Software Addresses Union Payroll Challenges

.png)

Construction-specific payroll software like Lumber provides solutions for the unique demands of union payroll processing:

Automated Compliance Management: Software systems track current union regulations and collective bargaining agreement terms, automatically applying correct pay rates, classifications, and benefit calculations. This reduces manual errors and ensures compliance with complex union rules.

Efficient Deductions and Benefits: Automated systems calculate union dues based on specific formulas, manage multiple benefit fund contributions, and generate required reports for union offices and benefit administrators. This reduces administrative time and improves accuracy.

Multi-Classification Wage Management: Union payroll software handles multiple job classifications, each with distinct pay rates and rules. The system applies the correct rate based on worker classification, project type, and hours worked, eliminating manual calculation errors.

Real-Time Reporting: Modern platforms provide instant access to payroll data, allowing quick review of labor costs, fund contributions, and workforce expenses. This visibility enables better project budgeting and financial decision-making.

Prevailing Wage Compliance: For projects requiring prevailing wages, specialized software ensures correct wage determinations are applied and proper documentation is maintained for compliance verification.

By implementing specialized payroll software, construction companies reduce administrative burden, minimize compliance risks, and ensure accurate, timely payment to workers and benefit funds.

Making the Right Choice: Union vs Non-Union Employment

When considering construction employment, understanding these distinctions helps workers make informed career decisions.

Evaluating Union vs Non-Union Opportunities

Union Benefits:

- Higher base wages averaging $33.86 per hour vs. $25.16 for non-union

- Comprehensive benefits worth $22.26 per hour vs. $11.32 for non-union

- Guaranteed health insurance (96% coverage vs. 69% non-union)

- Retirement contributions averaging $4.85 per hour vs. $1.12 non-union

- Job security protections and legal representation

- Standardized pay scales eliminating wage disparities

- Free training and apprenticeship programs through union training centers

- Workplace safety advocacy and hazard identification training

Non-Union Considerations:

- No union dues requirements

- Potential for individualized compensation negotiations

- More flexibility in work arrangements for some positions

- Opportunities for specialized or project-based work

- Simpler job application and hiring processes

- Direct relationships with employers

Total Compensation Comparison:

The wage premium for union membership is substantial. A union worker earning $33.86 per hour with $22.26 in benefits receives $116,730 in annual total compensation. A comparable non-union worker earning $25.16 per hour with $11.32 in benefits receives $83,760 annually—a difference of $32,970 or 39%.

For specific demographic groups, union membership provides even larger advantages. Hispanic and Latino workers earn 39% more with union membership, African American workers earn 26% more, and women earn 24% more compared to their non-union counterparts.

Industry Outlook for 2026

The construction industry faces a critical labor shortage, needing 499,000 new workers in 2026 as spending increases and interest rates potentially decline. This shortage creates opportunities for both union and non-union workers as contractors compete for talent.

Average construction wages have risen significantly, with construction workers earning 24% more than the average private sector worker. This wage growth is expected to continue at 4-6% annually through 2026, with premium markets potentially seeing 6-8% increases.

Workers with certifications, specialized skills, and technology proficiency command the highest premiums. Skills in Building Information Modeling (BIM), renewable energy systems, data center construction, and advanced equipment operation are particularly valuable.

The shortage also means better working conditions and benefits as contractors work to attract and retain workers. Both union and non-union employers are offering sign-on bonuses, retention incentives, and enhanced training programs.

Frequently Asked Questions

What is union payroll?

Union payroll is a compensation system for workers represented by labor unions. Key features include:

- Wages and benefits are negotiated through collective bargaining agreements

- Standardized pay scales ensure consistent compensation for similar work

- Predetermined wage rates eliminate individual negotiations

- Union dues are deducted from paychecks to fund union operations and services

- Comprehensive benefits including health insurance, retirement plans, and paid leave

- Legal protection and representation in workplace disputes

What’s the difference between union and non-union construction sites?

Union and non-union sites differ in several key areas:

Employment Conditions: Union sites operate under standardized conditions negotiated by the union. Non-union sites establish individualized arrangements between employers and workers.

Job Security: Union sites provide greater protection against arbitrary dismissal, plus legal support through the union. Non-union sites offer less formal job security.

Wage Determination: Union sites apply preset wage rates from collective agreements. Non-union sites allow individual salary negotiations.

Benefits: Union sites provide comprehensive, standardized benefits to all workers. Non-union sites offer variable benefits depending on employer policies.

Worker Representation: Union sites have collective advocacy and professional negotiators. Non-union sites require individual workers to negotiate for themselves.

What is the pay difference between union and non-union workers?

Based on 2025 data:

- Union construction workers average $33.86 per hour

- Non-union construction workers average $25.16 per hour

- This represents an hourly wage gap of $8.70 or approximately 26%

When benefits are included:

- Union workers receive total compensation of $56.12 per hour ($116,730 annually)

- Non-union workers receive total compensation of $40.27 per hour ($83,760 annually)

- Total compensation gap: $15.85 per hour or $32,970 annually (39% difference)

Wage variations depend on:

- Geographic location (higher in metropolitan areas and coastal states)

- Specific trade (electricians and heavy equipment operators earn more)

- Experience level and certifications

- Local labor market conditions

- Project type and funding source

How does union payroll software differ from regular payroll software?

Union payroll software provides specialized functionality:

Compliance Automation: Automatically applies complex union regulations and collective bargaining agreement terms, ensuring calculations match current union rules.

Union-Specific Deductions: Manages union dues calculations based on specific formulas, tracks multiple benefit fund contributions, and generates required union reports.

Classification Management: Handles varied pay rates based on job classifications, experience levels, and project types as specified in union contracts.

Overtime and Premium Pay: Calculates overtime using union-specific rules that may differ from standard labor law, including double-time pay and shift differentials.

Benefit Administration: Tracks and manages standardized union benefit packages, automates contribution calculations for health and welfare funds, and maintains pension plan records.

Reporting and Documentation: Provides detailed reporting for union offices, benefit administrators, and compliance audits with specialized formats required by unions.

These capabilities address the additional complexity union contractors face compared to standard payroll processing, reducing errors and administrative burden while ensuring compliance.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec ullamcorper mattis lorem non. Ultrices praesent amet ipsum justo massa. Eu dolor aliquet risus gravida nunc at feugiat consequat purus. Non massa enim vitae duis mattis. Vel in ultricies vel fringilla.

Introduction

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus. Quis velit eget ut tortor tellus. Sed vel, congue felis elit erat nam nibh orci.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

Mi tincidunt elit, id quisque ligula ac diam, amet. Vel etiam suspendisse morbi eleifend faucibus eget vestibulum felis. Dictum quis montes, sit sit. Tellus aliquam enim urna, etiam. Mauris posuere vulputate arcu amet, vitae nisi, tellus tincidunt. At feugiat sapien varius id.

Eget quis mi enim, leo lacinia pharetra, semper. Eget in volutpat mollis at volutpat lectus velit, sed auctor. Porttitor fames arcu quis fusce augue enim. Quis at habitant diam at. Suscipit tristique risus, at donec. In turpis vel et quam imperdiet. Ipsum molestie aliquet sodales id est ac volutpat.

- Lectus id duis vitae porttitor enim gravida morbi.

- Eu turpis posuere semper feugiat volutpat elit, ultrices suspendisse. Auctor vel in vitae placerat.

- Suspendisse maecenas ac donec scelerisque diam sed est duis purus.

Lectus leo massa amet posuere. Malesuada mattis non convallis quisque. Libero sit et imperdiet bibendum quisque dictum vestibulum in non. Pretium ultricies tempor non est diam. Enim ut enim amet amet integer cursus. Sit ac commodo pretium sed etiam turpis suspendisse at.

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

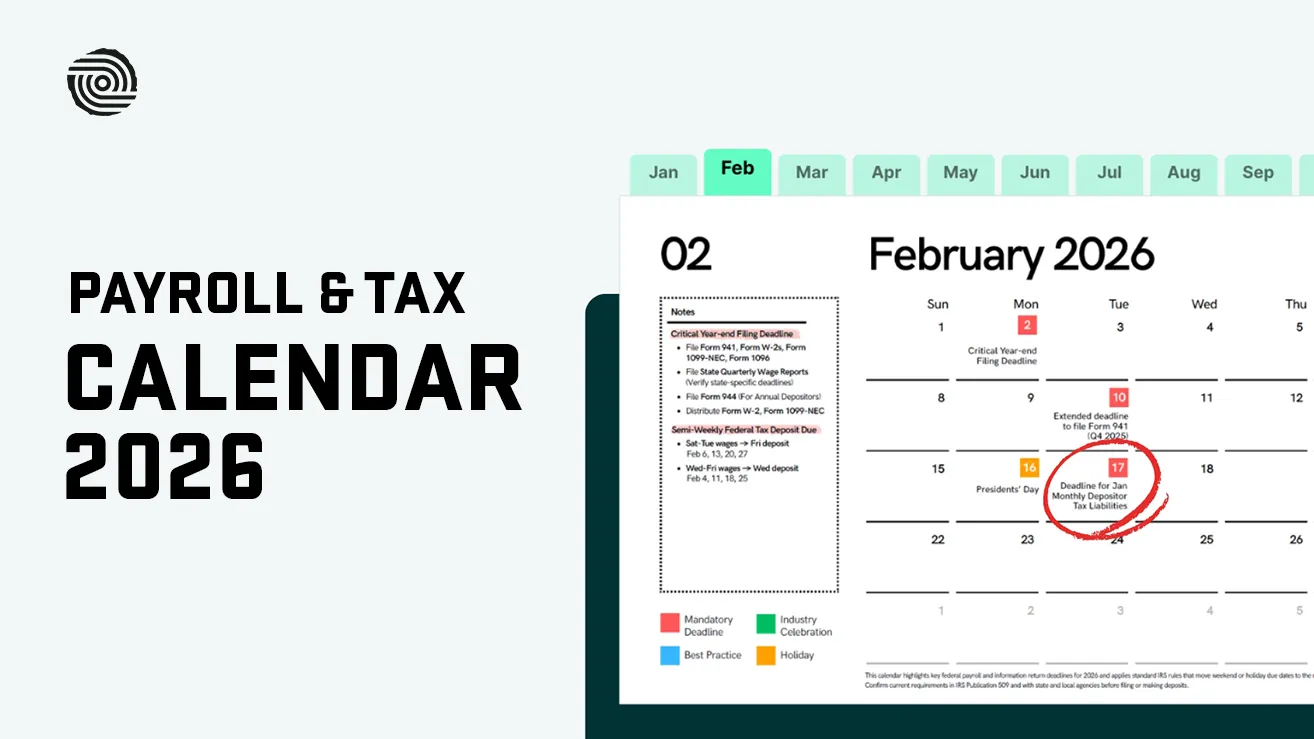

Critical Construction Compliance | Awareness Week

Mar 16, 2026

Apr 15, 2026

Nov 30, 2026

Dec 15, 2026

Essential resources for contractors